Spotlight on Property Tax Reappraisal

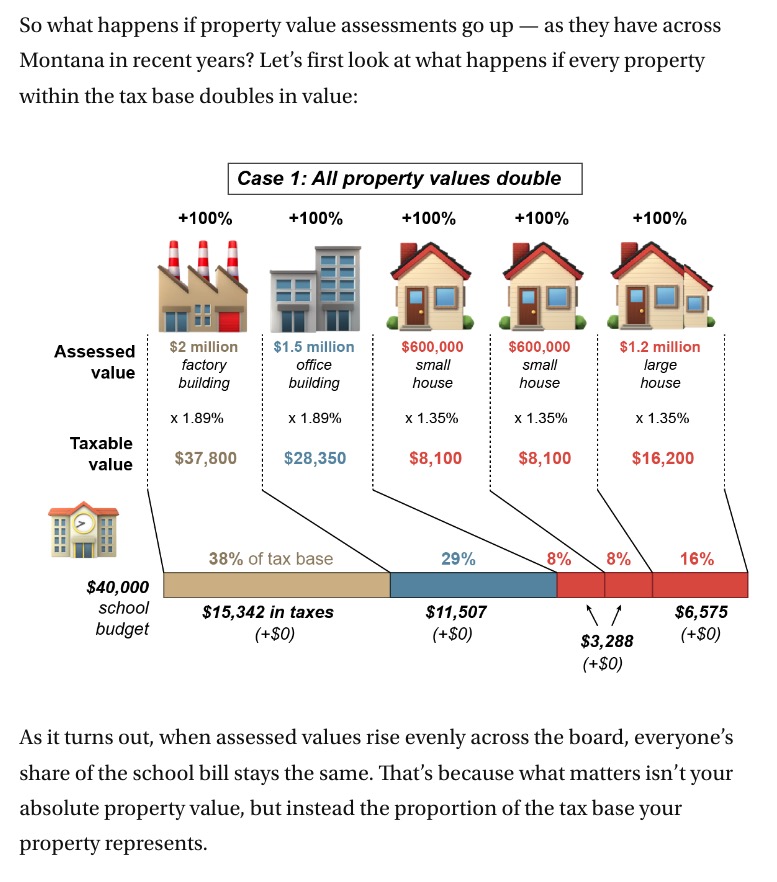

Many Montanans have now received their property tax reappraisal from the state Department of Revenue. And it almost certainly went up. For some, WAY up. But what does that actually mean as far as your upcoming property tax bill is concerned? Perhaps not much, actually. That’s because even though YOUR assessment went up, many property owners assessments went up too. When it comes to what you pay in property taxes, what really matters is not your increase in taxable value, but how your assessment has increased relative to everyone else’s assessments. Below is a snapshot from an excellent article in the Montana Free Press explaining this.

As the author of the piece goes on to explain, using more helpful graphics, if assessment increases are not equal across property classes some properties may see a tax increase. However, he also advises caution when you’re hit with the sticker shock of the state’s estimate for your next tax bill. “[I]f you call your county treasurer and ask, they’ll probably tell you that the state’s estimate won’t be what you see when they send your actual tax bill out this fall.”

If you’d like to learn more from the Department of Revenue, the agency responsible for calculating and sending your property reassessments, they’ll be in Billings starting tomorrow. Or, you can attend an online meeting.

- July 6th, 12:00 – 1:30pm, Online, Click Here to Join

- July 6th, 4:00 – 7:00pm, Billings Public Library

- July 11th, 9:30 – 11:30am, Stillwater Building, 3rd floor

- July 12th, 8:30 – 10:00am, Online, Click Here to Join

- July 17th, 5:30 – 7:00pm, Online, Click Here to Join

- July 25th, 4:00 – 5:30pm, Online, Click Here to Join

Unfortunately, much of the discussion on social media revolves around who to point fingers at—political parties, recent transplants, local governments—and it’s not helpful. We advise you skip the social media toxicity, read the MTFP article in full, and opt to Keep Calm and Property Owner On.