Three Phase Approach

The federal response to the novel Coronavirus crisis has come in three legislative packages. The first and second were signed into law on March 6th and March 18th respectively. The first package was a straightforward emergency response package to give funds to emergency response efforts. The second package (which will take effect April 2nd) among other things, requires employers to provide paid sick leave to workers affected by coronavirus and makes available a tax credit to reimburse employers for that sick leave. You can read more about these two bills in the Billings Chamber’s Summary of Congress’s Response to COVID-19.

CARES Act Summary (3rd Phase)

This post focuses exclusively on phase three – the $2 trillion bill to lessen the economic hardships faced by Americans. Senate Majority Leader Mitch McConnel said on March 25th, “We cannot outlaw the virus. And no economic policy can fully end the hardship so long as the public health requires that we put so much of our commerce on ice. This isn’t even a stimulus package. It is emergency relief.” (Source) Despite running into a few roadblocks, the bill passed the Senate with an unanimous 96-0 vote, moving it to the House where it is expected to get a vote this week before the President signs it into law.

Here are a few of the bill’s key provisions for Montana and for the business community we think you should know. Following is a more detailed summary.

Assistance Important to Montanans

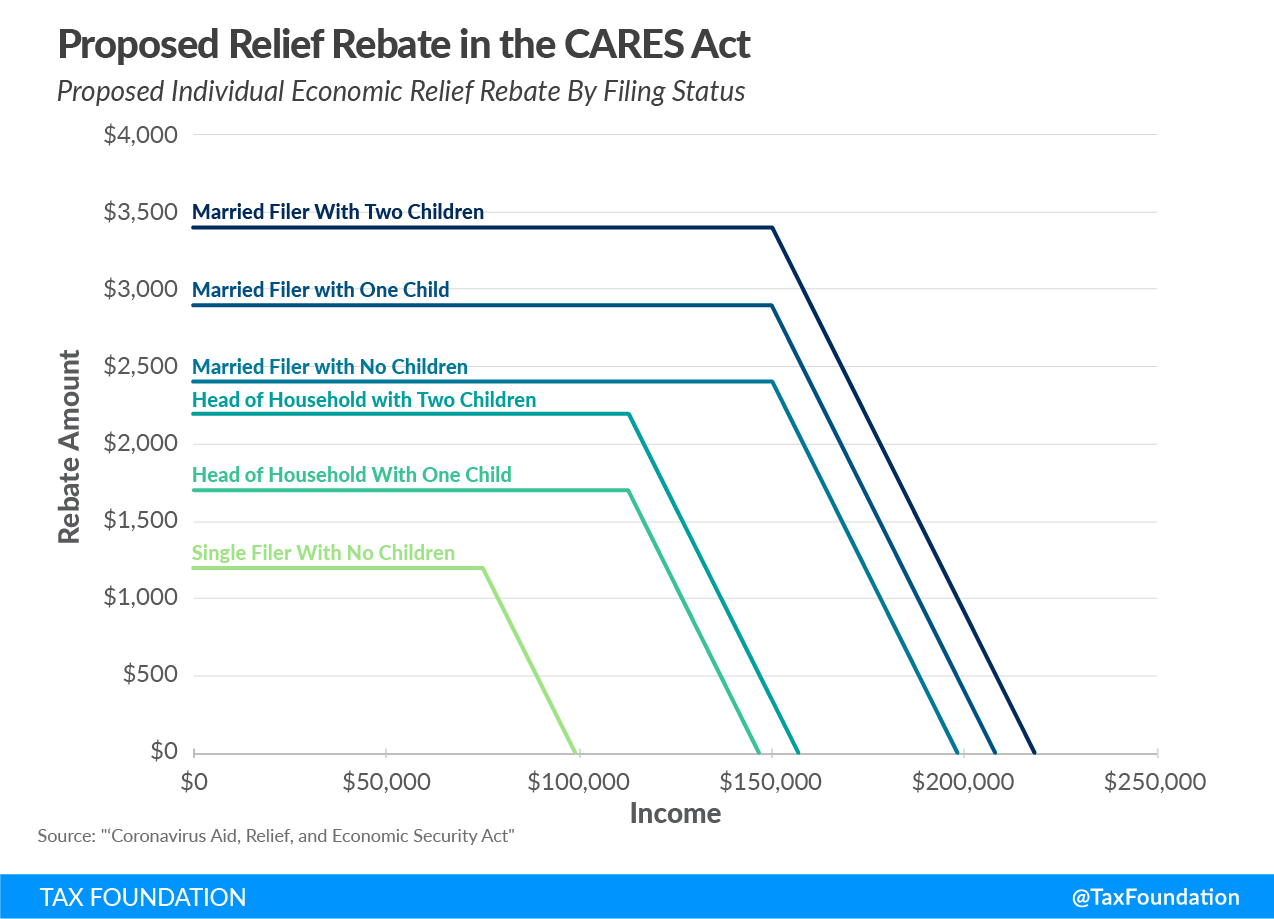

- Cash assistance to Montanans (see Tax Foundation graphic below)

- Low- and middle-income individuals will receive $1,200 with $2,400 for couples

- Additionally, $500 per child

- Declining amount for individuals earning between $75,000 and $99,000 or between $150,000 and $198,000 for couples

- Above $99,000 for individuals or $198,000 for couples receive no cash assistance

- Based on 2019 tax returns

- $1.25 billion to Montana to address economic hardships due to the novel Coronavirus

- $560 million of which must go to local governments

- $56 million for Essential Air Service (for us, this includes our Cape Air flights that connect eastern Montana to Billings)

- $23.5 billion for the farmers and ranchers of the U.S. Ag community

- $100 million expanded funding for Rural Development Broadband ReConnect program

- $25 million for Distance Learning and Telemedicine program to assist rural Montana

- A total of $9.8 Billion made available to assist Indian tribes through various programs.

Top 3 Business Topics

- $350 billion for Small Business Administration (SBA) Loans

- Paycheck Protection Program provides 8 weeks of cash-flow assistance to help employers retain employees. If employers can maintain their payroll, the portion of the loans used to cover payroll, interest on mortgages, rent, and utilities is forgiven—making the loan more like a grant.

- Retroactive to February 15, 2020 with hopes of bringing employees back onto payroll.

- 6-month deferral on Small Business Loans

- Non-profits, independent contractors, and self-employed individuals may delay paying 2020 employer payroll taxes until 2021 and 2020 (50% by the end of each year)

Overall Summary

The following summary was compiled and sent from the Office of Senator Steve Daines.

Unemployed workers:

- Includes more than $250 billion to expand unemployment insurance to those hit hardest, through no fault of their own, by the pandemic.

- Provides nearly full wages for up to four months by providing an additional $600 per week to workers – this would more than double the checks in Montana, and all of it fully reimbursable by the federal government.

- Makes eligible the self-employed, independent contractors, and non-profit/religious workers

- Includes an additional 13 weeks, fully reimbursed by the federal government, for those who have not returned to the workforce by the time their standard benefits end.

Small businesses:

- More than $350 billion for Small Businesses, including grants to make payroll for businesses that retain their full workforce.

- Delay for paying 2020 employer payroll taxes until 2021 and 2020 (50% by the end of each year). Qualifying businesses include: non-profits, independent contractors, and self–employed individuals. Provides Loan Authority to allow business to go to a financial institution of their choice and qualify for a grant.

- $562 million to help small businesses by ensuring SBA has the resources to provide Economic Injury Disaster Loans (EIDL) to businesses that need financial support. This will help businesses keep their doors open and pay their employees.

Healthcare workforce and infrastructure:

- $100 billion to provide direct aid to hospitals, public entities, non-profits, and Medicare and Medicaid enrolled suppliers and institutional providers to cover costs related to this crisis.

- $11 billion to accelerate drug development to treat and prevent COVID-19.

- $16 billion to replenish the Strategic National Stockpile supplies of pharmaceuticals, personal protective equipment, and other medical supplies.

- $250 million to expand the Hospital Preparedness Program’s support of emergency preparedness.

- $1 billion for the Defense Production Act to bolster domestic supply chains, enabling industry to quickly ramp up production of personal protective equipment, ventilators, and other urgently needed medical supplies.

- Expands the Medicare hospital accelerated payment program during the COVID-19 public health emergency to help hospitals, including those in rural and frontier areas, maintain an adequate workforce, buy essential supplies, create additional infrastructure, and keep their doors open to care for patients.

- Extends mandatory funding for community health centers, the National Health Service Corps, and the Teaching Health Center Graduate Medical Education Program at current levels through November 30, 2020.

Tribes:

- $8 billion set aside for tribal governments achieving equal treatment in funding with state and local governments.

- $1.03 billion to the Indian Health Service to support tribal health care system response efforts;

- $453 million to assist tribes through the Bureau of Indian Affairs

- $69 million to help tribal schools, colleges and universities with online education through for the Bureau of Indian Education

- $300 million more to the HUD Indian Housing Block Grant program.

Veterans:

- $15.85 billion for to help our nation’s veterans including purchase test kits, and procure personal protective equipment for clinicians.

- $425 million to increase access to mental health services in communities.

Agriculture economy:

- $23.5 billion for farmers and ranchers, including $9.5 billion for a new program to provide relief for livestock producers and other commodities

- $133 million for USDA to continue critical inspections to maintain food safety and our food supply

Seniors: (Medicare related provision)

- Lifts the Medicare sequester, which reduces payments to providers by 2 percent, from May 1 through December 31, 2020, boosting payments for hospital, physician, nursing home, home health, and other care.

- Allows Medicare beneficiaries to access telehealth, including in their home, from a broader range of providers, reducing COVID-19 exposure.

- $200 million for CMS to assist nursing homes with infection control and support states’ efforts to prevent the spread of coronavirus in nursing homes.

Medicaid beneficiaries:

- Extends the Medicaid Money Follows the Person demonstration that helps patients transition from the nursing home to the home setting through November 30, 2020.

- Extends the Medicaid spousal impoverishment protections program through November 30, 2020 to help a spouse of an individual who qualifies for nursing home care to live at home in the community.

- Delays scheduled reductions in Medicaid disproportionate share hospital payments through November 30, 2020.

- Extends the Medicaid Community Mental Health Services demonstration that provides coordinated care to patients with mental health and substance use disorders, through November 30, 2020. It would also expand the demonstration to two additional states.

Education & Child Care:

- $30.75 billion in grants to provide emergency support to local school systems and higher education institutions to continue to provide educational services to their students and support the on-going functionality of school districts and institutions.

- Students can stop making payments on federal student loans through September 30, 2020 without accruing interest.

- $3.5 billion in additional funding for the Child Care Development Block Grant to provide child care assistance to health care sector employees, emergency responders, sanitation workers, and other workers deemed essential during the response to the coronavirus

- Allows employers to provide student loan repayment benefit, up to $5,250, to employees on a tax free basis. This would last through the end of 2020.

First Responders:

- Provides $100 million to FEMA’s Assistance to Firefighters grant program for the purchase of personal protective equipment and related supplies.

- State and local government:

- At least $1.25 billion to the State of Montana to help the state and local governments meet the financial burdens associated with the coronavirus outbreak. Local Montana governments must receive at least 45 percent of these funds.

Rural Transportation:

- Provides $10 billion in formula funding for airports, $56 million for Essential Air Service to ensure rural airports and underserved routes are maintained, and $1 billion to Amtrak to ensure routes like the Empire Builder can be maintained throughout the emergency and $1 billion to Amtrak to ensure routes like the Empire Builder can be maintained throughout the emergency.

- $56 million for Essential Air Service to ensure rural airports and underserved routes are maintained

- Includes the Delay REAL ID Act, which delays enforcement for at least one year

Rural Broadband and Telemedicine:

- $100 million expanded funding for Broadband Pilot program under the Rural Utility Service and $25 million for Distance Learning and Telemedicine and Broadband Program.

- $200 million for the FCC to support telehealth deployment.

- Allows a high-deductible health plan (HDHP) with a health savings account (HSA) to cover telehealth services prior to a patient reaching the deductible, increasing access for patients who may have the COVID-19 virus and protecting other patients from potential exposure.

Nutrition programs:

- $8.8 billion for child nutrition programs

- $15.8 billion for SNAP

- $100 million in food assistance for tribes

Postal Service:

- $10 billion additional borrowing authority for the Postal Service and flexibility to prioritize medical deliveries.

Housing:

- More than $7 billion for affordable housing and homelessness assistance programs

Casino Industry:

- Local casinos now have a very valuable resource available to them during this trying time. The White house announced that on Friday, April 24th that small casinos will now be eligible for the Paycheck Protection Program. Previously, businesses that received a third or more of annual revenue from gambling were unable to apply for these loans. Any business wishing to apply for one of these loans can do so through their local bank or credit union. This comes at a pivotal time for Montana casinos as Governor Bullock announced earlier in the week that he would allow casinos to reopen on May 4th. Casinos that do open will have to operate under strict guidelines for the foreseeable future; they must close by 11:30 pm, and either space gaming machines 7 feet apart on center, or unplug any machines that cannot be adequately distanced from others.

For additional resources related to the COVID-19 pandemic, please refer to our COVID-19 Resources page, where you will find local, state, and national information to assist you through this time.